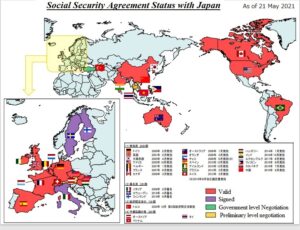

Social Security agreement status

When working abroad, you must be enrolled in the social security system of the country you are working in, and occasionally you are obliged to pay contributions to both countries. On the other hand, to be eligible for the pension benefits under the system of each country, you may need to be covered by the system for a certain length of period. Accordingly, you may not be eligible for benefits even if you contribute to the system due to a shortage of the coverage period.

Social security agreements are concluded for the following purposes:

Aggregation of your contribution periods

To enable you to aggregate your periods of both Japan and your home country to fill the gap for benefits under the system of the agreement country so that you may qualify for benefits.

Germany, United States of America, Belgium, France, Canada, Australia, Netherlands, Czech Republic, Spain, Ireland, Brazil, Switzerland, Hungary, India, Luxembourg, Philippines and Slovakia (As of 21 May, 2021)

Elimination of dual pension contribution

To avoid “dual pension contribution” by arranging your compulsory coverage between Japan and your home country.

Germany, United States of America, Belgium, France, Canada, Australia, Netherlands, Czech Republic, Spain, Ireland, Brazil, Switzerland, Hungary, India, Luxembourg, Philippines and Slovakia (As of 21 May, 2021)

(Addition)

UK, Korea, Italy, China

Related Foreign Sites

Germany

![]() Deutsche Verbindungsstelle Krankenversicherung-Ausland(DVKA)

Deutsche Verbindungsstelle Krankenversicherung-Ausland(DVKA)

![]() Deutsche Rentenversicherung Bund

Deutsche Rentenversicherung Bund

U.K.

Korea

U.S.

![]() Social Security Administration

Social Security Administration

![]() Embassy of the United States in Japan

Embassy of the United States in Japan

Belgium

![]() Federal Public Service Social Security

Federal Public Service Social Security

![]() National Office for Social Security (ONSS)

National Office for Social Security (ONSS)

![]() National Institute for the Social Security of the Self-employed (INASTI)

National Institute for the Social Security of the Self-employed (INASTI)

![]() National Institute for Sickness and Invalidity Insurance (INAMI)

National Institute for Sickness and Invalidity Insurance (INAMI)

![]() Caisse de Secours et de Prevoyance en faveur des Marins / Hulp-en Voorzorgskas voor Zeevarenden

Caisse de Secours et de Prevoyance en faveur des Marins / Hulp-en Voorzorgskas voor Zeevarenden

France

![]() Centre des Liaisons Europeennes et Internationales de Securite Sociale (CLEISS)

Centre des Liaisons Europeennes et Internationales de Securite Sociale (CLEISS)

![]() Caisse Nationale D’Assurance Vieillesse (CNAV)

Caisse Nationale D’Assurance Vieillesse (CNAV)

![]() L’Assurance Maladie(Health Insurance in France)

L’Assurance Maladie(Health Insurance in France)

Canada

![]() Employment and Social Development Canada

Employment and Social Development Canada

Australia

Netherlands

![]() Uitvoeringsinstituut Werknemersverzekeringen(UWV)

Uitvoeringsinstituut Werknemersverzekeringen(UWV)

Czech

![]() Czech social Security Administration

Czech social Security Administration

![]() Ministry of Health of the Czech Republic

Ministry of Health of the Czech Republic

Italy

![]() Ministero del Lavoro e delle Politiche Sociali(LPS)

Ministero del Lavoro e delle Politiche Sociali(LPS)

![]() Istituto Nazionale di Previdenza dei Giornalisti Italiani(INPGI)

Istituto Nazionale di Previdenza dei Giornalisti Italiani(INPGI)

![]() Istituto Nazionale della Previdenza Sociale(INPS)

Istituto Nazionale della Previdenza Sociale(INPS)

Spain

![]() Ministerrio de Trabajo e Inmigración

Ministerrio de Trabajo e Inmigración

Ireland

![]() Social Welfare Service of the Department of Social Protection

Social Welfare Service of the Department of Social Protection

Brazil

![]() Ministério da Previdência Social, Instituto Nacional do Seguro Social(INSS)

Ministério da Previdência Social, Instituto Nacional do Seguro Social(INSS)

Switzerland

![]() Federal Social Insurance Office

Federal Social Insurance Office

Hungary

![]() ORSZÁGOS NYUGDÍJBIZTOSÍTÁSI FŐIGAZGATÓSÁG(ONYF)

ORSZÁGOS NYUGDÍJBIZTOSÍTÁSI FŐIGAZGATÓSÁG(ONYF)

![]() Országos Egészségbiztosítási Pénztár(OEP)

Országos Egészségbiztosítási Pénztár(OEP)

India

![]() Employees’ Provident Fund Organization(EPFO)

Employees’ Provident Fund Organization(EPFO)

Luxembourg

![]() Ministére de la Sécurité Sociale

Ministére de la Sécurité Sociale

![]() Caisse nationale d’assurance pension

Caisse nationale d’assurance pension

![]() Centre commun de la sécurite sociale

Centre commun de la sécurite sociale

Philippines

![]() Government Service Insurance System

Government Service Insurance System

Slovak Republic

China

![]() Ministry of Human Resources and Social Security

Ministry of Human Resources and Social Security

For Japanese nationality, working in oversea

【申請書一覧(加入免除手続き)】/【国民年金の被保険者のための申請書】/【適用証明書】

ドイツ、英国、韓国、アメリカ合衆国、ベルギー、フランス、カナダ、オーストラリア、オランダ、チェコ、スペイン、アイルランド、ブラジル、スイス、ハンガリー、インド、ルクセンブルグ、フィリピン、スロバキア、中国

【日本の年金請求者・受給者のための申請書】/【年金請求者のための申請書】

ドイツ、アメリカ合衆国、ベルギー、フランス、カナダ、オーストラリア、オランダ、チェコ、スペイン、アイルランド、ブラジル、スイス、ハンガリー、インド、ルクセンブルグ、フィリピン、スロバキア

Note: Agreements with United Kingdom, Republic of Korea , Italy and China include “elimination of dual coverage” only.

英国、韓国、イタリア、中国と日本との2国間社会保障協定は、国籍を有する国の社会保障料、または居住する国の社会保障料のどちらか一方で納めていれば、他方の国の社会保障料支払いは免除されます。

コメント