- National Pension System

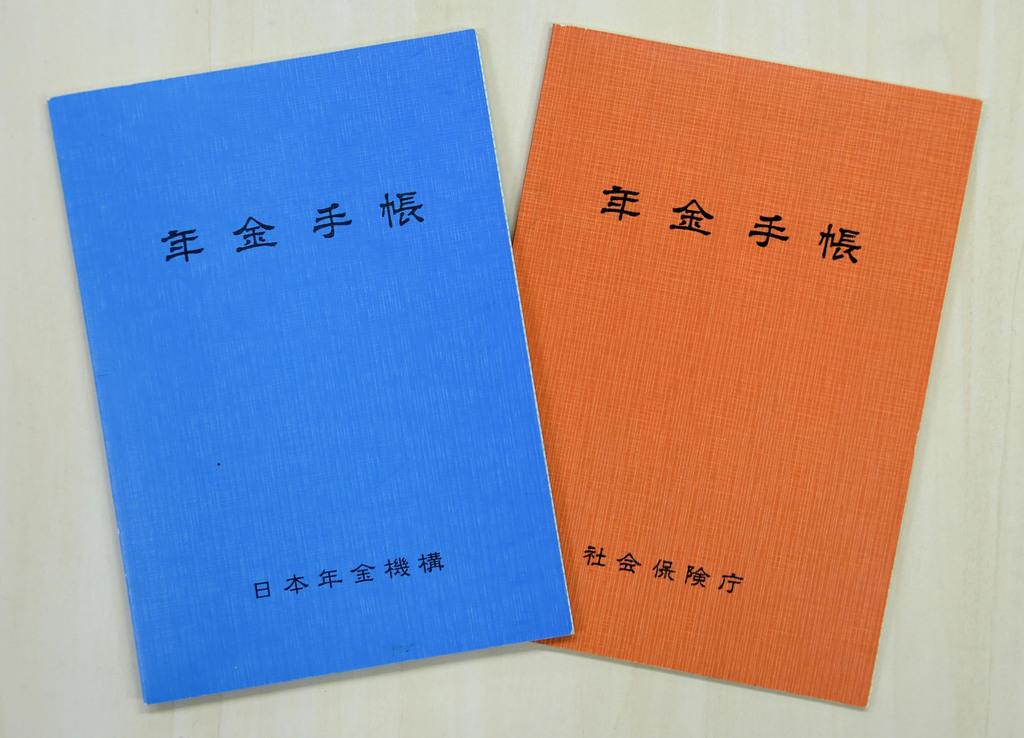

- Contributions

- Pamphlet in various languages

- Municipal Pension offices, phone book

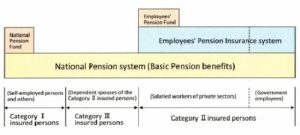

National Pension System

The National Pension is a public pension system participated by all persons aged 20 to 59 years who have an address in Japan, which provides benefits called the “Basic Pension” due to old age, disability, or death.

Compulsory Coverage

All registered residents* of Japan aged 20 to 59 years must be covered by the National Pension system. The insured are categorized according to their status as follows:

*Excluding foreign nationals, with visa for medical stay or for long stay for sightseeing

Category Ⅰ insured persons:

All registered residents of Japan aged 20 to 59 years who are not Category II or III insured persons (agriculture, forestry, or fishery business operators, self-employed persons, students, etc.)

Category Ⅱ insured persons:

Persons enrolled in the Employees’ Pension Insurance system or Mutual Aid Associations (except for persons aged 65 to 69 years who are eligible to receive a pension due to old age or retirement)

Category Ⅲ insured persons:

Category II insured person’s dependent spouses aged 20 to 59 years, who reside in Japan

Note: Persons must be covered as Category I insured persons, for the periods from their entry to Japan until when they are registered as Category II or Category III insured persons

How to Enroll in the System and Register yourself under each Category

When you become subject to the Category I insured person, you need to register yourself at your Municipal Office within 14 days, by submitting the “Application to Enroll in National Pension as Category I Insured Person” (KOKUMIN NENKIN HIHOKENSHA KANKEITODOKESHO (MOUSHIDESHO).

When you become subject to the Category II insured person, on your behalf your employer needs to enroll you in the Employees’ Pension Insurance or the Mutual Aid Associations. Within the procedure you are automatically enrolled in the National Pension, so you do not need to take extra procedure.

When you become a Category III insured person, have your spouse’s employer, etc. register you at the Japan Pension Service Branch Office (JPS Branch Office) that covers your spouse’s company within 14 days, by submitting the “Application to Enroll in National Pension as Category Ⅲ Insured Persons” (KOKUMIN NENKIN : SANGO HIHOKENSHA KANKEITODOKE).

Voluntary Coverage

The following persons can enroll in the National Pension system on a voluntary basis;

(1) Registered residents of Japan aged 60 to 64 years

(2) Japanese citizens aged 20 to 64 years who reside in a foreign country

(3) Persons born on or before April 1, 1965, aged 65 to 69 years who have not satisfied the minimum qualification period

How to Enroll for Voluntary Coverage

If you are subject to (1),(3) above, and wish to enroll voluntarily, you need to apply for enrollment at the Municipal Office where you reside. If you are subject to (2) above, you need to apply for enrollment at the JPS Branch Office in charge of your latest residence in Japan. If you have never resided in Japan, you need to apply at the JPS Chiyoda Branch Office, Tokyo.

Contributions

The contribution amount for the National Pension is JPY16,540/month (for the fiscal year 2020)

Payment of the Contributions

Pay the contributions at a bank, post office, or convenience store using the payment notices sent to you by the Japan Pension Service. You may take advantage of a discount by opting for advance payment through automatic bank remittance, credit card payment, etc.

Exemption of the Contributions

You can apply for the exemption from contribution payments if you satisfy certain conditions specified by law, specifically, if you are receiving the Disability Basic Pension or the Public Assistance under the Livelihood Protection Act. You may also be exempt from contribution payments if the previous year’s income of you/your spouse/your home owner is low, and if your application for exemption is granted.

The type of exemption is as follows: full-amount-exemption,3/4-amount-exemption (monthly contributions payable: \4,140(for the fiscal year 2020)), half-amount-exemption (monthly contributions payable: \8,270(for the fiscal year 2020)) and 1/4-amount-exemption (monthly contributions payable: \12,410(for the fiscal year 2020)).

For the purpose of calculation of your pension benefits, your periods of full-amount -exemption for March 2009 and earlier will count as one-third of full-contribution-paid periods (the 3/4-amount-exemption periods will count as half, the half-amount -exemption periods as two-thirds and the 1/4-amount-exemption periods as five-sixths). Your periods of full-amount-exemption for April 2009 and later will count as half of full-contribution-paid periods (the 3/4-amount-exemption periods will count as five-eighths, the half-amount exemption periods as three-fourths and the 1/4-amount -exemption periods as seven-eighths).

If you fail to pay the due remaining contribution amount during the granted period, however, it will be considered to be non-payment rather than partial exemption.

How to Apply for Exemption

To establish the exemption, you need to apply at the Municipal Office where you reside and register. You need to apply for the exemption every year.

Recovery of the Past Exempted-Contribution

You may retroactively make payments for past contribution-exempted periods for up to the past 10 years. Please note that a specific index will be imposed on your past contribution amount when you recover the payments. That is, if you were granted the contribution exemption in a certain fiscal year (April to March) and if you wish to recover the contribution three or more fiscal years later, your old contribution amount is indexed by certain rate according to the age of the due contribution.

How to Recover the Exempted Contribution

For retroactive payments, please contact your nearest JPS Branch Office.

Special Payment System for Students

If you are a student and your income is less than a certain amount, you may be allowed to postpone contribution payment if your application is approved.

This granted period protects you just as the regular coverage periods do. So, if you become disabled or die during this granted period, the Disability Basic Pension or the Survivors’ Basic Pension will be provided if you satisfy the following conditions;

(1) By the second month preceding the month of your accident, etc., your non-payment period (months) does not exceed one-third of your months of full coverage.

or

(2) You paid your contributions for the last 12 months up to the second month preceding the month of your accident, etc.

This granted periods count as qualifying periods for the Old-age Basic Pension, however, unless you recover contribution payments afterwards, the periods will not be reflected to the old-age benefit amount.

You can retroactively pay the postponed contribution in the same way as the “Recovery of the Past Exempted-Contribution” above.

How to Apply for Special Payment System for Students

To establish the exemption, you need to apply at the Municipal Office where you reside and register. The application form is available at the Municipal Offices or the JPS Branch Offices.

Contribution Postponement System for Low Income Persons

If you are aged under 50 and your/your spouse’s income is lower than a certain level, this system allows you to postpone your contribution payments. It aims to protect persons who are not granted contribution exemption, from failing to qualify for benefits in later life. To establish your postponement, your application needs to be granted.

If you become disabled or die during this granted periods, the Disability Basic Pension or the Survivors’ Basic Pension will be provided if you satisfy the same conditions mentioned in “Special Payment System for Students” above.

This granted periods count as qualifying periods for the Old-age Basic Pension, however, unless you recover contribution payment afterwards, the periods will not be reflected to the old-age benefit amount.

You can apply for postponement system or retroactively pay the postponed contribution in the same way mentioned in “Exemption of the Contributions” and “Recovery of the Past Exempted-Contribution” above.

Deferred payment system for National Pension contributions

The payment period for National Pension contributions expires in two years from the original due date, preventing you from making payment. Any contribution due and unpaid in the past 5 years that could not be paid due to expiration of the payment period, however, may now be paid only during the three years between October 1, 2015, and September 30, 2018 (deferred payment system).

This deferred payment system may allow you to increase the amount of your pension benefits or become eligible for pension benefits if you have not been eligible in the past.

See here for more details of the deferred payment system.

Pamphlet in various languages

Korean Rev. 1st April 2020

Portuguese Rev. 1st April 2020

Spanish Rev. 1st April 2020

Indonesian Rev. 1st April 2020

Vietnamese Rev. 9th June 2020

Myanmar Rev. 1st April 2020

Nepali Rev. 1st April 2020

Mongolian Rev. 1st April 2020

Municipal Pension offices, phone book

https://www.nenkin.go.jp/international/english/offices/offices.files/list.pdf

Japan Pension Service, head office

3-5-24, Takaido-nishi, Suginami-Ku,

Tokyo 168-8505 JAPAN

〒168-8505 東京都杉並区高井戸西 3 丁目 5 番 24 号

日本年金機構 (外国業務グループ)

Phone TEL. +81 – 3 – 6700 – 1165

(The telephone service is in Japanese.)

コメント