Pension Note

Orange color Pension Note = Issued between November 1974 and December 1996

Blue color Pension Note = Issued after January 1997.

It indicates your unique pension ID number, called Kiso Nenkin Bangou (基礎年金番号)which is identical for following three different pension systems.

For your pension related inquiry, application, start to work at a company in Japan etc, you are required to specify your Kiso Nenkin Bangou (ID number).

| Written in Japanese | ||||

| 1 | National Pension | NP | Kokumin Nenkin | 国民年金 |

| 2 | Employees’ Pension Insurance | EPI | Kousei Nenkin | 厚生年金 |

| 3 | Mutual Aid system | kyousai Nenkin | 共済年金 | |

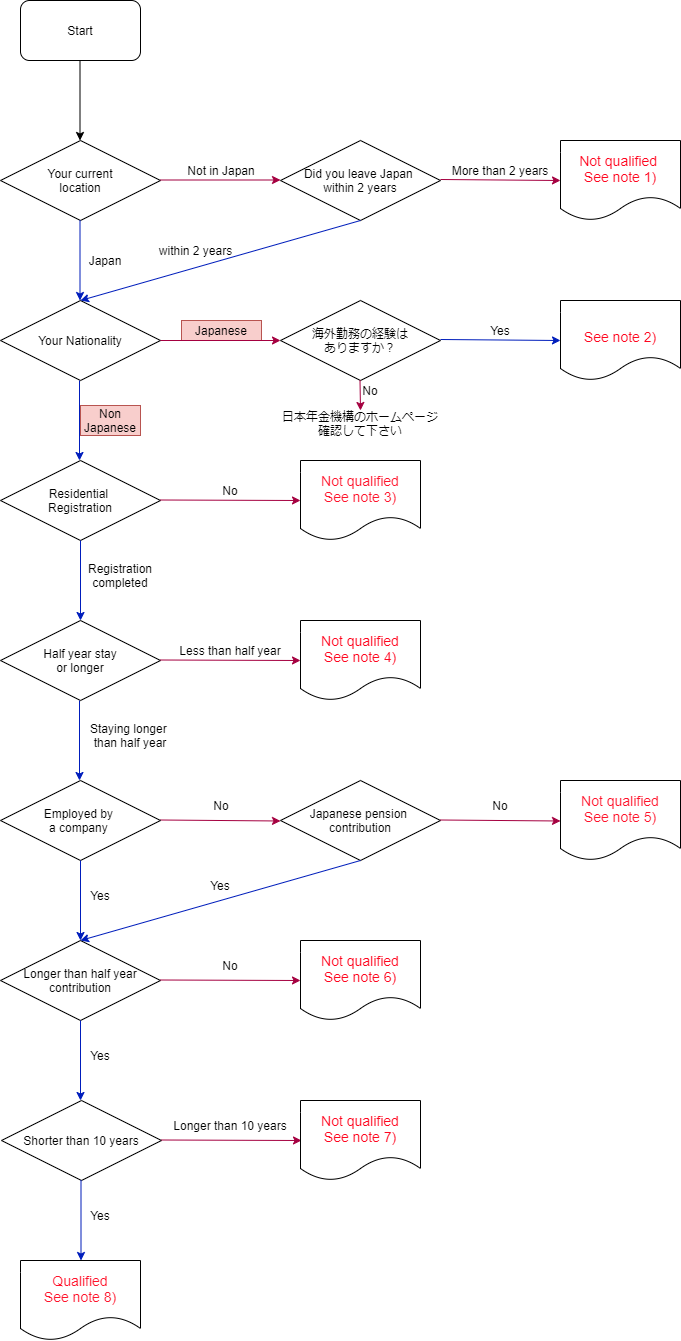

Lump-sum withdrawal payment eligibility

Let’s check your pension lump-sum withdrawal eligibility.

(Comment for Japanese) 下記の国とは、社会保険に関し2国間相互協定があります。過去現在を問わず、お住まい中・お住まいだった国名をクリックし、詳細を確認されることをお勧めいたします。

手続きの期限を過ぎると、権利を失う場合もありますので、ご注意下さい。

【申請書一覧(加入免除手続き)】/【国民年金の被保険者のための申請書】/【適用証明書】

ドイツ、英国、韓国、アメリカ合衆国、ベルギー、フランス、カナダ、オーストラリア、オランダ、チェコ、スペイン、アイルランド、ブラジル、スイス、ハンガリー、インド、ルクセンブルグ、フィリピン、スロバキア、中国

【日本の年金請求者・受給者のための申請書】/【下記国の年金請求者のための申請書】

ドイツ、アメリカ合衆国、ベルギー、フランス、カナダ、オーストラリア、オランダ、チェコ、スペイン、アイルランド、ブラジル、スイス、ハンガリー、インド、ルクセンブルグ、フィリピン、スロバキア

The period for which the pension is contributed is the period during which you have Basic Resident Registration (住民基本台帳登録 in Japanese) in the city or ward where you actually live in Japan. It is not defined by the date of your arrival or departure from Japan that is recorded in your passport.

If you do not register as a resident in Japan and continue to stay at a hotel or other place, you will not be eligible for the pension system.

Please be noted, at your filing of pension withdrawal application, you may be required to use your name writing in Katakana (Japanese angler Script) if you would use it for your initial Basic Resident Registration.

In order to receive your pension withdrawal payment, it is required to contribute your pension for a period of more than half a year.

When you registered as a basic resident at the city hall or ward office, you should have been given a payment form for the national pension. If you have not settled your payment, you are not eligible to receive your pension.

- You have coverage periods, i.e., you have/had been covered, under the EPI for six months or more. Or you have six months or more of coverage period in total under the NP (as a CategoryⅠinsured person), including;

– Number of your coverage periods (months) for which you paid full amount contribution

– 3/4 of your coverage periods (months) for which you were exempt from 1/4 contribution payment

– 1/2 of your coverage periods (months) for which you were exempt from 1/2 contribution payment

– 1/4 of your coverage periods (months) for which you were exempt from 3/4 contribution payment - You no longer have a address in Japan registered to the municipal office.

- You have never been entitled to Japanese public pension benefits including Disability Allowance.

NP = National Pension (国民年金、Kokumin Nenkin in Japanese)

EPI= Employees’ Pension Insurance (厚生年金、Kousei Nenkin in Japanese)

Minimum 10 years contribution is required to receive Japanese Pension. When you could fulfill it, you will be able to receive Japanese pension from your age 65 for your life time long.

This case you can not apply “Lump-sum withdrawal” payment.

If your country has no pension agreement with Japan, and your pension contribution is less than 10 years pension, you shall apply “Lump-sum withdrawal payment” after your resident cancellation, but within 2 years. I would miss it, you shall lose your privilege. The application form is attached below. (last section of this article)

On the contrary, if your country would have a bilateral pension agreement with Japan, you have an option, not to apply “Lump-sum withdrawal payment”. This case, you will be able to receive the relevant pension from Japanese pension office, for your life time long when you will become 65 years old.

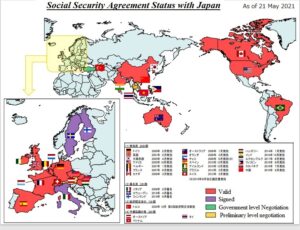

Bilaterally pension agreed countries

Select your country and click it for more details.

Germany, United Kingdom, Republic of Korea, United States, Belgium, France, Canada, Australia, Netherlands, Czech Republic(*), Spain, Ireland, Brazil, Switzerland, Italy, Hungary, India, Luxembourg, Philippines, Slovak Republic, China

Signed (Under preparation for implementation) Italy,Sweden,Finland

Reference ⇒ Bilateral pension agreements

As of October 2019, the status of the conclusion of social security agreements is as follows. Japan has concluded agreements with twenty countries. Please note that the elimination of dual coverage and the aggregation of coverage periods are possible only between Japan and these countries.

Note: Agreements with United Kingdom, Republic of Korea , Italy and China include “elimination of dual coverage” only.

If your country is not included in bilateral pension agreed countries

You are eligible to file the lump-sum pension withdrawal application within 2 years after your residential cancellation. If you would miss to apply it, you will lose your privilege.

Application forms in various languages

Read this application form first

100-215-226-651 Last updated date:5 12 2020

If you are non-Japanese and you have short coverage periods under the National Pension system or the Employees’ Pension Insurance system, you can apply for the Lump-sum Withdrawal Payments. Please make sure you are no longer covered by these pension systems, and you file the application for the Payments within two years since you leave Japan.

Following pdf documents include “Application for the Lump-sum Withdrawal Payments

(National Pension / Employees’ Pension Insurance). If your country has Bilateral pension agreement with Japan, you have an option, not to apply for it.

Quote

If you apply and are entitled to the Lump-sum Withdrawal Payments, all your past coverage periods used as basis of the Payments amount calculations will no longer be valid to apply for other Japanese benefits. Please carefully read the important information on page 4 of this Payments brochure / application. If you still opt for your Payments after due consideration for possible future pension benefits, please make sure to sign in the column 2. If you have long coverage periods and yet fail to sign, we may return your application to ask you again about your decision.

Unquote

コメント