Identify your group

| Pension Type | National Pension | EPI | Mutual Aid |

| Your Nationality ↓ | Self Employed Shop Owner | Company Employee | Academic Field Government Worker |

| Germany, USA, Belgium, France, Canada, Australia, Netherlands, Czech Republic, Spain, Ireland, Brazil, Switzerland, Hungary, India, Luxembourg, Philippines, Slovak Republic | Group A | Group B | |

| Italy, Korea, England, China, and Others | Group C | Group D | |

(Table – 1)

Italy, Korea, England, China

Social Security bilaterally agreed, but limited for elimination of dual pension contribution

Amount of Lump-sum withdrawal

Group A (Listed Nationality & National Pension contributor)

| 6 ~ 60 months | 61 ~ 119 months | 120 months or longer | |

| Withdrawal payment amount | 49,830~498,300 | 498,300 | Lump-sum withdrawal is not applicable |

| If you do not apply “Withdrawal” within 2 years after your residential cancellation in Japan before your final departure. | Contributed periods in Japan and in your home country shall be aggregated |

|

|

Group B (Listed Nationality & Employees’ Pension Insurance contributor)

| Monthly Salary level (See Table 5) | 6 ~ 60 months | 61 ~ 119 months | 120 months or longer |

| Level 09 (146,000 ~ 155,000) | 75,000 ~ 825,000 | 825,000 | Lump-sum withdrawal is not applicable |

| Level 17 (250,000 ~ 270,000) | 130,000 ~ 1,430,000 | 1,430,000 | ditto |

| Level 21 (330,000 ~ 350,000) | 170,000 ~ 1,870,000 | 1,870,000 | ditto |

| Level 25 (425,000 ~ 455,000) | 220,000 ~ 2,420,000 | 2,420,000 | ditto |

| Level 29 (545,000 ~ 575,000) | 280,000 ~ 3,080,000 | 3,080,000 | ditto |

| Level 32 (650,000 over) | 325,000 ~ 3,575,000 | 3,575,000 | ditto |

| If you do not apply “Withdrawal” within 2 years after your residential cancellation in Japan before your final departure. | Contributed periods in Japan and in your home country shall be aggregated |

|

|

Remarks – The amounts payable to you are subject to tax withholding of 20.42%.

Group C (Others’ Nationality & National Pension contributor)

| 6 ~ 60 months | 61 ~ 119 months | 120 months or longer | |

| Withdrawal payment amount | 49,830~498,300 | 498,300 | Lump-sum withdrawal is not applicable |

| If you do not apply “Withdrawal” within 2 years after your residential cancellation in Japan before your final departure. | Zero | Zero |

|

Group D (Others’ Nationality & Employees’ Pension Insurance contributor)

| Monthly Salary level (See Table 5) | 6 ~ 60 months | 61 ~ 119 months | 120 months or longer |

| Level 09 (146,000 ~ 155,000) | 75,000 ~ 825,000 | 825,000 | Lump-sum withdrawal is not applicable |

| Level 17 (250,000 ~ 270,000) | 130,000 ~ 1,430,000 | 1,430,000 | ditto |

| Level 21 (330,000 ~ 350,000) | 170,000 ~ 1,870,000 | 1,870,000 | ditto |

| Level 25 (425,000 ~ 455,000) | 220,000 ~ 2,420,000 | 2,420,000 | ditto |

| Level 29 (545,000 ~ 575,000) | 280,000 ~ 3,080,000 | 3,080,000 | ditto |

| Level 32 (650,000 over) | 325,000 ~ 3,575,000 | 3,575,000 | ditto |

| If you do not apply “Withdrawal” within 2 years after your residential cancellation in Japan before your final departure. | Zero | Zero |

|

Remarks – The amounts payable to you are subject to 20.42% withholding tax.

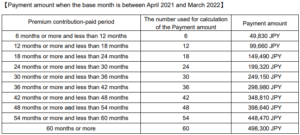

Lump-sum withdrawal payment table for National Pension (NP)

(Table -2)

(Table -3)

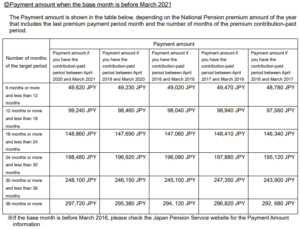

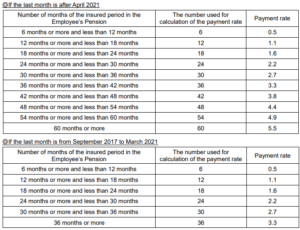

Lump-sum withdrawal Payment table for Employees’ Pension Insurance

(Table – 4)

Identify your ASR (Average Standard Remuneration)

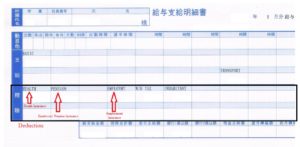

Typical Payroll Sheet

Three red arrows indicate Social Security items. Your employer also contributes for these three items.

- EPI = 18.3% (9.15% each for employer and employee) of standard payment table (See Table 9)

- Medical and Health Insurance, age below 40 = 9.87% (4.935% each, ditto)

- Medical and Health Insurance, age 40 and over = 11.66% (5.83% each, ditto)

- Employment Insurance = 0.9% (0.6% for employer, 0.3% for employee) of payment amount.

For example, if your monthly salary level is belonging to Level 27 = JPY 500,000.

For EPI, JPY45,750 (JPY500,000 x 9.15%) is deducted monthly.

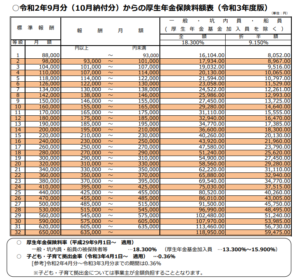

The latest Standard payment & pension contribution table

(Table – 5)

Pensions’ estimation (Age 65 or more, for pension eligible contributors)

National Pension estimation

If your National Pension contribution period exceeds 10 years , you are eligible to receive following amount annually for your life time, from your age 65. (as of June 2021)

| Contribution period | 10 years | 20 years | 30 years | 40 years |

| Life time National Pension | 195,225 | 390,450 | 585,675 | 780,900 |

(Table – 6)

Employees’ Pension Insurance estimation

If your Employees’ Pension Insurance (EPI) contribution period exceeds 10 years, you are eligible to receive total amount of NP and EPI from your life time from your age 65.

| EPI contribution period | ||||

| Standard monthly salary level | 10 years | 20 years | 30 years | 40 years |

| Level 09 (146,000 ~ 155,000) per month | 294,089 | 588,166 | 882,255 | 1,176,332 |

| Level 17 (250,000 ~ 270,000) per month | 359,861 | 719,710 | 1,079,571 | 1,439,420 |

| Level 21 (330,000 ~ 350,000) per month | 425,633 | 851,254 | 1,276,887 | 1,702,508 |

| Level 25 (425,000 ~ 455,000) per month | 491,405 | 982,798 | 1,474,203 | 1,965,596 |

| Level 29 (545,000 ~ 575,000) per month | 557,177 | 1,114,342 | 1,671,519 | 2,228,684 |

| Level 32 (650,000 over) | 646,723 | 1,293,432 | 1,940,156 | 2,586,865 |

(Table – 7)

Remarks

The annual pension amount above includes both NP and EPI.

コメント